Introduction

In today’s ever-changing healthcare landscape, selecting the right individual health insurance plan is crucial for protecting your well-being and financial future. Whether you are self-employed, a freelancer, or simply need coverage outside of a group plan, understanding how individual health insurance works and comparing options is key to making an informed decision. In this blog post, we’ll guide you through the process of comparing individual health insurance plans and explain what factors you should consider to find the best plan for your needs.

What is Individual Health Insurance?

Individual health insurance is a policy purchased by an individual, rather than being provided through an employer or government program. It offers coverage for medical services such as doctor’s visits, hospital stays, preventive care, and prescriptions. In the United States, individual health insurance can be purchased through the Health Insurance Marketplace (also known as the Exchange) or directly from private insurers.

Types of Individual Health Insurance Plans

There are various types of individual health insurance plans available, each with different benefits, coverage levels, and costs. Here are the most common types:

- Health Maintenance Organization (HMO)

- Key Features: Requires members to choose a primary care physician (PCP), who coordinates all care. Referrals from the PCP are required to see specialists.

- Pros: Typically lower premiums and out-of-pocket costs.

- Cons: Less flexibility in choosing healthcare providers.

- Preferred Provider Organization (PPO)

- Key Features: Offers more flexibility when choosing healthcare providers and doesn’t require referrals to see specialists.

- Pros: Greater freedom to choose doctors and hospitals.

- Cons: Higher premiums and out-of-pocket costs compared to HMOs.

- Exclusive Provider Organization (EPO)

- Key Features: Similar to PPO plans but with a stricter network. Out-of-network care is not covered except in emergencies.

- Pros: Lower premiums than PPOs, good coverage for in-network services.

- Cons: Limited flexibility in choosing healthcare providers.

- Point of Service (POS)

- Key Features: Combines elements of HMO and PPO plans. You need a primary care physician and referrals for specialists, but you can also see out-of-network providers at a higher cost.

- Pros: A mix of lower premiums with some flexibility for out-of-network care.

- Cons: Referrals required for specialist visits.

- High Deductible Health Plans (HDHP)

- Key Features: Offers lower premiums but higher deductibles. Often paired with a Health Savings Account (HSA) that allows you to save money tax-free for medical expenses.

- Pros: Lower premiums, tax savings through an HSA.

- Cons: Higher out-of-pocket costs before insurance kicks in.

Factors to Consider When Comparing Individual Health Insurance Plans

Choosing the best individual health insurance plan involves assessing several factors. Here are the key elements you should consider when comparing plans:

1. Monthly Premiums

The premium is the amount you pay every month for your health insurance coverage. It’s one of the most obvious factors to consider, but the cheapest plan isn’t always the best value. While low-cost plans may seem appealing, they may have higher out-of-pocket costs when you need care. Be sure to balance the premium with the other costs.

2. Deductibles and Copayments

The deductible is the amount you must pay out-of-pocket for medical services before your insurance starts covering costs. Copayments (or co-pays) are fixed amounts you pay for services, like doctor visits or prescriptions, even after you’ve met your deductible. Plans with lower premiums often come with higher deductibles and copayments.

3. Out-of-Pocket Maximums

The out-of-pocket maximum is the most you’ll have to pay for covered services in a year. Once you reach this limit, the insurance company covers all additional costs for the remainder of the year. Understanding this limit is crucial because it gives you a clear picture of how much you could spend in the worst-case scenario.

4. Network of Providers

Health insurance plans have networks of doctors, hospitals, and clinics they work with to provide services at a lower cost. Some plans, like HMOs and EPOs, have smaller networks, while PPOs typically offer a broader range of choices. Ensure that your preferred healthcare providers are in the plan’s network to avoid higher out-of-network costs.

5. Prescription Drug Coverage

Prescription drug coverage is a vital consideration if you take regular medications. Make sure the plan offers a good formulary (list of covered drugs) and check the cost of the medications you currently use. Some plans may charge more for brand-name drugs or require you to use generic options.

6. Additional Benefits

Some individual health plans offer additional perks, such as dental, vision, and wellness programs. While these benefits may not be essential, they can add value to your coverage if they align with your needs. Look for plans that offer a broad range of services to enhance your overall healthcare experience.

7. Plan Ratings and Customer Service

Research the insurance company’s reputation and customer service. Reading reviews and ratings from current or past policyholders can give you a better understanding of how the insurer handles claims and provides customer support. A company with a poor reputation for handling claims could cost you more time and frustration in the long run.

How to Compare Individual Health Insurance Plans

Step 1: Assess Your Health Needs

Start by evaluating your health status and the care you anticipate needing in the coming year. Are you healthy with few doctor visits? Or do you have chronic conditions that require regular treatment? Your health needs will help you determine what type of coverage you need, such as prescription drug coverage or access to specialists.

Step 2: Use an Insurance Comparison Tool

Use comparison websites or tools to compare multiple plans side-by-side. These platforms allow you to filter by factors such as premium, deductible, out-of-pocket maximum, and plan type. Be sure to input accurate information to get the most relevant results for your situation.

Step 3: Understand the Cost Structure

Review the plan’s cost breakdown, including premiums, deductibles, co-pays, and out-of-pocket limits. Consider your budget and how much you’re willing to pay out-of-pocket for healthcare. A low premium plan might save you money each month, but high out-of-pocket costs can quickly add up if you need frequent care.

Step 4: Evaluate the Provider Network

Make sure the plan covers doctors, hospitals, and specialists that you trust and frequently visit. If you have specific healthcare providers you want to stay with, confirm that they participate in the plan’s network.

Step 5: Double-Check Prescription Coverage

If you take prescription medications, check if they are covered under the plan’s formulary and the cost of your medications. Some plans may offer better coverage for certain drugs, so ensure you’re not paying out-of-pocket for necessary prescriptions.

Step 6: Consider Extra Benefits

Look for additional benefits like dental, vision, mental health services, or wellness programs. While these may not be a deal-breaker, they can provide value and help you stay healthy and covered for a broader range of services.

Conclusion: Finding the Right Individual Health Insurance Plan

Choosing the right individual health insurance plan can be overwhelming, but by understanding the different types of plans, comparing key factors, and assessing your personal healthcare needs, you can find a plan that suits both your health and your budget. Take the time to explore your options, and don’t hesitate to reach out to insurance brokers or customer support for additional guidance.

If you’re still unsure which plan is right for you, many online resources can help you make side-by-side comparisons, and during open enrollment, you can also seek professional assistance to help navigate the complexities of individual health insurance plans. By making an informed choice now, you can have peace of mind knowing you’re covered when you need it most.

FAQs about Individual Health Insurance Plans

When it comes to individual health insurance, there are many questions people have as they navigate the process of selecting the right coverage. Here are some of the most common FAQs to help you make an informed decision:

1. What is the difference between an HMO, PPO, EPO, and POS plan?

- HMO (Health Maintenance Organization): Requires you to choose a primary care physician (PCP) who coordinates all your care and refers you to specialists. HMO plans usually have lower premiums but less flexibility.

- PPO (Preferred Provider Organization): Offers more flexibility in choosing healthcare providers and doesn’t require referrals. PPOs typically have higher premiums but more choices for in-network and out-of-network care.

- EPO (Exclusive Provider Organization): Similar to PPOs but with a more limited network. Care outside the network is typically not covered, except in emergencies. EPOs can offer lower premiums than PPOs.

- POS (Point of Service): Combines elements of HMO and PPO plans. You need a PCP and a referral to see specialists, but you can go out-of-network at a higher cost. POS plans offer a balance between premiums and flexibility.

2. How do I know which health insurance plan is right for me?

To determine the right health insurance plan for your needs, consider the following:

- Your healthcare needs: Do you need regular medical care, or are you mostly healthy and only need coverage for emergencies?

- Budget: How much can you afford to pay in monthly premiums, deductibles, and co-pays?

- Preferred doctors: Are your doctors or specialists in the plan’s network?

- Coverage for medications: Do you take prescription medications regularly?

Use an insurance comparison tool to evaluate the options available to you based on these factors.

3. What is a deductible, and how does it work?

A deductible is the amount you must pay for covered medical services before your health insurance plan starts to pay. For example, if you have a $2,000 deductible, you must pay the first $2,000 of your medical bills. After that, your insurer will start covering a percentage of your costs, usually until you reach your out-of-pocket maximum.

Plans with lower premiums often have higher deductibles, meaning you pay more out-of-pocket before insurance takes over.

4. What is an out-of-pocket maximum?

The out-of-pocket maximum is the highest amount you will have to pay for covered medical expenses in a given year. Once you reach this amount, your insurer will cover 100% of your medical costs for the rest of the year. This limit includes deductibles, co-pays, and coinsurance, but not your premiums.

5. What are co-pays and co-insurance?

- Co-pay: A fixed amount you pay for a covered health service, typically at the time of service. For example, you might pay a $30 co-pay for a doctor’s visit.

- Co-insurance: The percentage of the cost of a medical service that you are responsible for after you’ve met your deductible. For example, if your plan has a 20% co-insurance, you pay 20% of the bill, and the insurance company pays the remaining 80%.

6. What is the Health Insurance Marketplace?

The Health Insurance Marketplace (also known as the Exchange) is an online service where you can compare and purchase individual health insurance plans. It was created under the Affordable Care Act (ACA) to help people find coverage, especially if they do not have access to employer-sponsored insurance. You can apply for financial assistance (like subsidies) through the Marketplace if you qualify based on income.

7. Can I switch my individual health insurance plan during the year?

In most cases, you can only change your individual health insurance plan during open enrollment (typically in the fall, though the exact dates may vary). However, if you experience a Qualifying Life Event (QLE) such as marriage, the birth of a child, losing your current insurance, or moving to a new state, you may be eligible for a Special Enrollment Period and switch your plan outside of the open enrollment period.

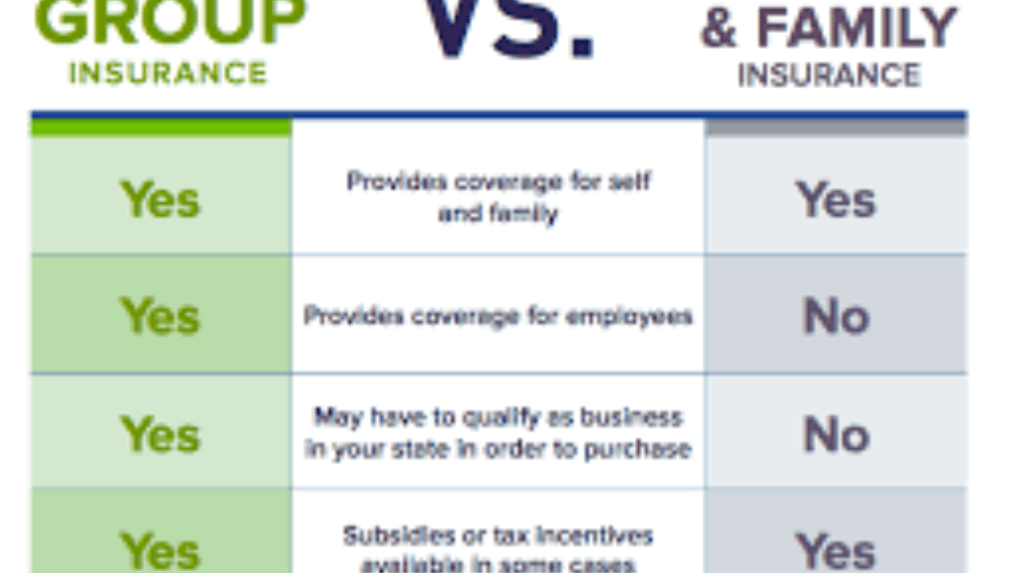

8. What is the difference between an individual health insurance plan and family health insurance?

An individual health insurance plan covers only one person, while a family health insurance plan covers you and your dependents (such as your spouse and children). While family plans typically have higher premiums, they provide coverage for multiple people under one policy, which can be more cost-effective than purchasing separate individual plans for each member of the family.

9. Are individual health insurance plans guaranteed issue?

Yes, under the Affordable Care Act (ACA), individual health insurance plans are guaranteed issue, meaning insurers cannot deny coverage based on your health status or pre-existing conditions. This was a significant change from the pre-ACA system, where people could be denied coverage due to their health history.

10. How can I lower my health insurance premiums?

There are several strategies you can use to lower your health insurance premiums:

- Opt for a higher deductible: Plans with higher deductibles usually have lower premiums.

- Choose a plan with a narrower network: HMO or EPO plans often have lower premiums than PPO plans.

- Use preventive care: Staying healthy can reduce your overall medical costs, which could lower your premiums over time.

- Check for subsidies: If you qualify based on income, you may be eligible for premium subsidies through the Health Insurance Marketplace.

11. Can I get a health insurance plan if I have pre-existing conditions?

Yes, under the Affordable Care Act (ACA), health insurance companies are not allowed to deny coverage or charge higher premiums based on pre-existing conditions. This protection ensures that people with chronic illnesses or previous medical conditions can obtain health coverage.

12. What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account that allows you to save money for healthcare expenses. It can be paired with a High Deductible Health Plan (HDHP). Contributions to an HSA are tax-deductible, and the funds can be used tax-free for eligible medical expenses. Unused funds roll over from year to year, making it a good option for saving for future healthcare needs.

13. How do I enroll in an individual health insurance plan?

You can enroll in an individual health insurance plan through the following methods:

- Through the Health Insurance Marketplace during open enrollment (or a Special Enrollment Period if you qualify).

- Directly from a health insurance company by visiting their website or speaking with an insurance agent.

- Via an insurance broker who can help you compare plans and navigate the enrollment process.

Be sure to provide accurate information about your health, income, and household to ensure that you select the right plan.

These FAQs cover some of the most important questions people have about individual health insurance plans. Understanding these basics will help you make a well-informed decision when comparing and selecting the right coverage for your needs. If you need more personalized assistance, it may be beneficial to consult with an insurance broker or use resources available through the Health Insurance Marketplace.