Introduction

When it comes to protecting your family’s financial future, a term life insurance policy can provide peace of mind and security without breaking the bank. Whether you’re looking for coverage to protect your mortgage, provide for your children’s education, or simply ensure your loved ones are financially secure, the best term life insurance policies offer affordable rates, flexible coverage, and a streamlined application process.

In this blog post, we’ll explore the best term life insurance policies for 2024, discussing key features, benefits, and how to choose the right policy for your needs.

What is Term Life Insurance?

Before diving into the top options for 2024, it’s important to understand what term life insurance is and why it may be the right choice for many consumers.

Term life insurance is a type of life insurance policy that provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If you pass away during the term of the policy, your beneficiaries receive a death benefit, which is typically paid out tax-free. If you outlive the term, the policy expires and no payout is made.

Unlike permanent life insurance policies (e.g., whole life or universal life), term life insurance is often much more affordable, making it an attractive option for young families or individuals seeking affordable coverage without a lifelong commitment.

Top Term Life Insurance Providers for 2024

1. Haven Life Insurance

Best for Affordable Coverage with a Simple Application

Haven Life, a subsidiary of MassMutual, is one of the top choices for term life insurance. Known for its straightforward online application process and competitive pricing, Haven Life makes it easy to get coverage quickly.

- Coverage Options: 10, 20, and 30 years

- Policy Amounts: $100,000 to $3 million

- Key Features: Haven Life offers a no-medical exam policy for eligible applicants, which means you can get coverage without needing to undergo a physical exam. This makes it an ideal choice for those who are looking for a quick and easy approval process.

- Customer Satisfaction: Haven Life has strong customer reviews and is well-regarded for its transparent pricing and ease of use.

Why Choose Haven Life: If you’re looking for an easy, affordable term life insurance policy that you can apply for online with minimal hassle, Haven Life is a solid choice.

2. Bestow Life Insurance

Best for Fast and Easy Digital Experience

Bestow is a digital-first life insurance provider that focuses on providing quick term life insurance policies with no medical exam required. The company uses technology to streamline the underwriting process, meaning you can get covered in as little as 5 minutes without the need for paperwork or doctor visits.

- Coverage Options: 10, 20, and 30 years

- Policy Amounts: $50,000 to $1.5 million

- Key Features: No medical exams required for applicants under the age of 55, which is a major selling point. Bestow uses a fully digital process to provide instant quotes and approval in just a few minutes.

- Customer Satisfaction: Customers appreciate the user-friendly online experience and fast approval times, although some have noted that larger coverage amounts may require additional steps.

Why Choose Bestow: Bestow is perfect for tech-savvy individuals who want to quickly compare term life insurance quotes and receive instant approval without a medical exam.

3. Term Life by Ladder

Best for Flexibility in Coverage Amounts

Ladder offers a unique advantage in the term life insurance market: flexibility. You can increase or decrease your coverage amount throughout the term of your policy, depending on your changing needs. This makes it a good option for individuals who anticipate changes in their financial situation over time.

- Coverage Options: 10, 15, 20, and 30 years

- Policy Amounts: $100,000 to $8 million

- Key Features: Ladder allows you to adjust your coverage without any fees or penalties, and it offers a quick online application process with an instant decision in many cases.

- Customer Satisfaction: Ladder has received high marks for its modern, tech-driven approach to term life insurance. Customers appreciate its simplicity, fast application, and flexible policy structure.

Why Choose Ladder: If you want the ability to adjust your coverage as your life and needs evolve, Ladder’s flexibility is a great advantage.

4. AIG Direct

Best for High Coverage Amounts

American International Group (AIG) offers one of the most comprehensive term life insurance policies available, especially for individuals seeking high coverage amounts. AIG is a well-established name in the insurance world, providing reliable coverage with a range of customizable options.

- Coverage Options: 10, 15, 20, and 30 years

- Policy Amounts: $100,000 to $10 million

- Key Features: AIG offers term life policies with flexible options, including riders for added benefits like accidental death or waiver of premium. They also offer competitive rates for those seeking large policy amounts.

- Customer Satisfaction: AIG has a long-standing reputation in the insurance industry, and its term life policies are well-regarded for their affordability and flexibility.

Why Choose AIG Direct: If you need a large death benefit or prefer to work with a well-established insurance provider, AIG offers great value with high coverage limits and reliable service.

5. Nationwide Life Insurance

Best for Family Protection Plans

Nationwide is another trusted name in the insurance industry, known for its family-friendly coverage options. Nationwide offers term life policies that are particularly well-suited for parents looking to ensure their children’s financial future in case the worst happens.

- Coverage Options: 10, 15, 20, and 30 years

- Policy Amounts: $100,000 to $10 million

- Key Features: Nationwide’s policies come with a convertible feature, allowing you to convert your term life insurance to a permanent policy without medical exams. They also offer a child rider, which can be added to your policy to provide coverage for your children.

- Customer Satisfaction: Nationwide has a solid reputation for customer service and is frequently praised for its financial strength and the ability to tailor policies to meet family needs.

Why Choose Nationwide: Nationwide is a strong option if you want a policy that can evolve with your changing needs, including options for converting to permanent life insurance and adding coverage for your children.

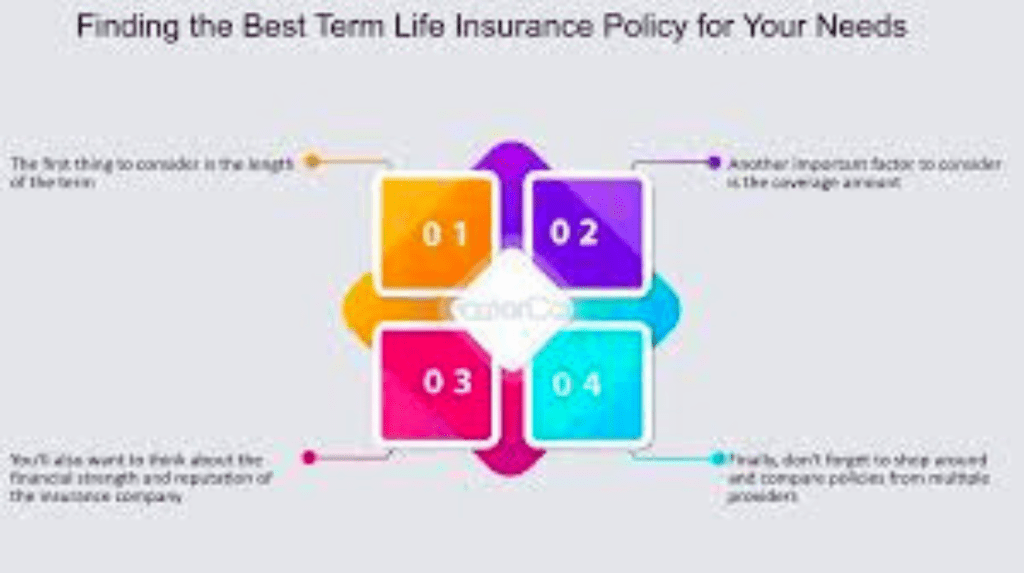

How to Choose the Best Term Life Insurance Policy for You

With so many options on the market, choosing the best term life insurance policy can be a challenge. Here are a few tips to help you make an informed decision:

- Assess Your Coverage Needs: Consider how much coverage you need and for how long. If you only need coverage for a few years (e.g., to cover your mortgage), a shorter term might be the best option. If you need long-term protection, opt for a 20 or 30-year term.

- Compare Premiums: Term life insurance policies are typically affordable, but premiums can vary. It’s important to get quotes from multiple insurers to ensure you’re getting the best deal.

- Consider Additional Features: Look for policies that offer flexibility (e.g., convertible policies or the ability to increase coverage), as well as options for adding riders like disability or critical illness coverage.

- Check the Insurer’s Reputation: Research the insurance company’s financial strength and customer service record. Companies with high ratings from organizations like A.M. Best and J.D. Power are generally more reliable.

Conclusion

The best term life insurance policy for you depends on your individual needs, budget, and preferences. In 2024, Haven Life, Bestow, Ladder, AIG Direct, and Nationwide offer some of the best options available, each with unique features and benefits.

By taking the time to compare policies and assess your financial situation, you can find the perfect coverage to protect your family and give yourself peace of mind for years to come.

Ready to Get Started?

Start by comparing term life insurance quotes from the top providers listed above, and take the first step toward securing a brighter future for your loved ones.

Frequently Asked Questions (FAQs) About Term Life Insurance

Choosing a term life insurance policy can feel overwhelming, especially with so many options available. To help guide you in your decision-making process, we’ve compiled answers to some of the most common questions about term life insurance.

1. What is term life insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period or “term,” such as 10, 20, or 30 years. If the insured individual passes away during the term of the policy, the beneficiary receives a death benefit. If the term expires and the insured person is still alive, the policy ends, and no payout is made. Term life is generally more affordable than permanent life insurance options like whole or universal life.

2. How much term life insurance coverage do I need?

The amount of coverage you need depends on your financial situation and goals. Generally, people choose coverage that replaces their income, covers outstanding debts (like a mortgage or student loans), and provides for future expenses (such as children’s education). A common guideline is to have coverage equal to 10 to 15 times your annual income, but it’s important to calculate your specific needs based on your circumstances.

3. How long should my term life insurance be?

The length of your term life insurance policy should match the number of years you expect to need coverage. Common term lengths are 10, 20, and 30 years. If you have young children or significant financial obligations, a 20- or 30-year term might be ideal to ensure your loved ones are protected until they are financially independent or your debts are paid off.

4. Can I convert my term life insurance to permanent life insurance?

Some insurers offer a convertible term life insurance policy, which allows you to convert your term policy to a permanent life insurance policy (like whole life or universal life) without undergoing a medical exam. This feature is beneficial if you want to switch to a permanent policy later on but don’t want to risk being denied due to health changes.

5. What factors affect the cost of term life insurance?

Several factors impact the cost of term life insurance, including:

- Age: Younger individuals typically pay lower premiums because they are considered less risky to insure.

- Health: Insurance companies may require a medical exam or health questionnaire. Those in good health usually pay lower premiums.

- Coverage Amount: The higher the coverage amount, the higher the premium.

- Term Length: Longer-term policies typically cost more, as they provide coverage for a longer period.

- Lifestyle and Occupation: Smokers, individuals with risky hobbies, or certain professions may face higher premiums.

6. Do I need a medical exam for term life insurance?

Some term life insurance policies require a medical exam, while others offer no-medical-exam options for eligible applicants. The no-medical-exam policies are typically available for individuals who are relatively healthy and under a certain age, making it easier and faster to secure coverage. However, policies that don’t require a medical exam may come with slightly higher premiums.

7. How do I apply for term life insurance?

The application process for term life insurance typically involves the following steps:

- Fill out an application: Provide personal details, such as your age, gender, health history, and lifestyle.

- Underwriting process: Depending on the insurer, you may need to complete a medical exam or answer health questions.

- Review of application: The insurer will assess your application and either approve, deny, or offer a modified policy based on your health.

- Policy issuance: Once approved, you’ll receive your policy, and coverage will begin.

Some insurers, like Haven Life and Bestow, offer a completely digital application process that can provide a decision in minutes without a medical exam.

8. What happens if I outlive my term life insurance policy?

If you outlive your term life insurance policy, it expires, and you no longer have coverage. In most cases, there is no refund of the premiums paid, as term life insurance is not an investment product. However, some policies may offer a return of premium option, where you receive the premiums back at the end of the term if you outlive the policy. These types of policies generally come with higher premiums.

9. Can I cancel my term life insurance policy?

Yes, you can cancel your term life insurance policy at any time, but keep in mind that you won’t receive any refund of premiums unless your policy has a return-of-premium feature. If you no longer need coverage or find a better policy, canceling is an option. However, if you’re considering switching policies, it’s essential to ensure you’re approved for a new policy before canceling the existing one, especially if your health has changed.

10. How do I compare different term life insurance policies?

When comparing term life insurance policies, consider the following factors:

- Premiums: Get quotes from multiple insurers to compare pricing for similar coverage.

- Coverage amount: Ensure the policy covers your financial obligations and provides enough for your loved ones.

- Term length: Choose a term that aligns with your financial needs (e.g., until your mortgage is paid off or your children graduate college).

- Riders and additional benefits: Some policies offer extra features like critical illness or accidental death coverage.

- Customer reviews: Check online reviews to gauge customer satisfaction with claims handling and service.

Using online comparison tools or working with an independent insurance agent can help you easily compare different policies to find the best fit for you.

11. What happens if I miss a payment on my term life insurance?

If you miss a premium payment, most insurers offer a grace period (typically 30-31 days) to pay the overdue amount without losing coverage. If you miss the grace period, your policy may lapse, meaning you no longer have coverage. Some policies may offer a reinstatement option, but you may need to provide evidence of insurability or pay any missed premiums with interest.

12. Can I add more coverage to my term life insurance policy?

It depends on the insurance company and the specific policy you choose. Some insurers, like Ladder and AIG, allow policyholders to increase their coverage amount during the term without undergoing a new medical exam. However, this may not be available with all insurers or policies, so it’s essential to check if this option is offered before purchasing a policy.

Conclusion

Term life insurance is a simple, affordable way to ensure your loved ones are financially protected in the event of your death. By understanding the basics of term life insurance and addressing common questions, you can make an informed decision about which policy is best for your needs. Whether you’re looking for affordable coverage with Haven Life, flexible options with Ladder, or high coverage limits with AIG, there’s a term life insurance policy out there that can fit your unique situation.

If you’re ready to get started, it’s always a good idea to compare quotes from different insurers, consider your coverage needs, and consult with an insurance professional to help guide you through the process.