Introduction

When it comes to securing your family’s financial future, choosing the right life insurance policy is one of the most important decisions you’ll make. Term life insurance is often the go-to choice for many individuals because of its affordability and simplicity. However, not all term life insurance policies are created equal, and the rates can vary significantly from one provider to another. In this blog post, we will explore how to compare term life insurance rates, what factors affect these rates, and how you can find the best deal for your needs.

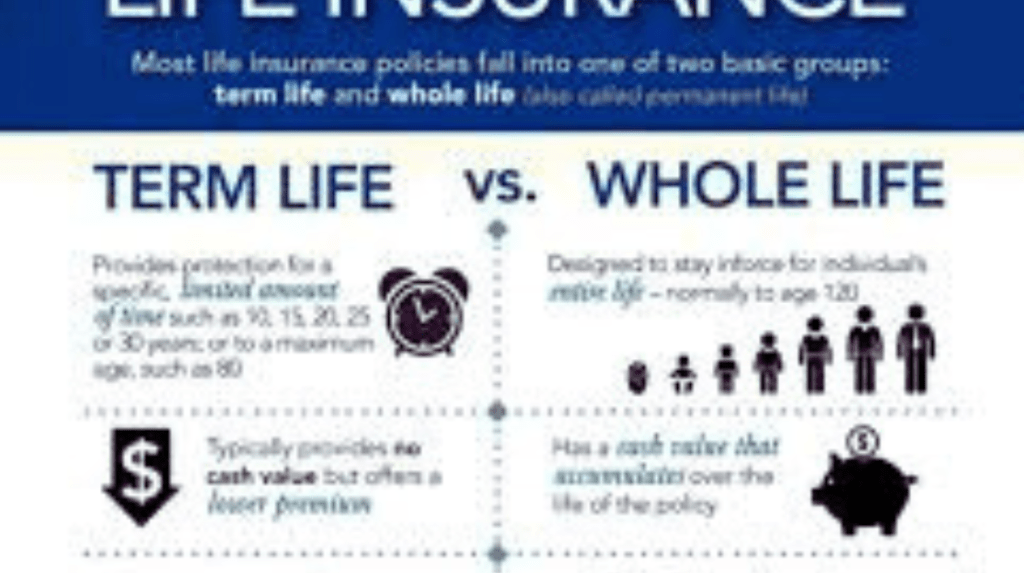

What is Term Life Insurance?

Before diving into rates, let’s quickly review what term life insurance is. Term life insurance is a policy that provides coverage for a specific period, or “term” (typically 10, 20, or 30 years). If the policyholder passes away during the term, the beneficiaries receive a death benefit. Unlike whole life insurance, which offers lifelong coverage and includes a cash value component, term life is straightforward: you pay premiums for a set period, and if you die during that time, your beneficiaries are paid.

Why Compare Term Life Insurance Rates?

Comparing term life insurance rates is crucial for several reasons:

- Cost Savings: Life insurance premiums can vary significantly between insurers. By comparing rates, you can ensure that you’re getting the most competitive price for the coverage you need.

- Find the Right Coverage: Different insurers may offer different coverage options or additional benefits. A comparison will help you find the policy that best fits your specific needs.

- Get the Best Value: It’s not just about the lowest premium. A thorough comparison can reveal which companies offer the best value, considering both cost and the quality of their customer service and claims process.

Factors That Affect Term Life Insurance Rates

Term life insurance rates can vary for many reasons. Understanding the key factors that impact pricing will help you make a more informed decision when shopping for coverage.

1. Age

Your age is one of the most significant factors in determining your term life insurance rate. Generally, the younger and healthier you are when you apply for life insurance, the lower your premiums will be. Insurers view younger applicants as less risky, as they are statistically less likely to pass away during the term of the policy.

2. Health

Insurance companies will typically require a medical exam to assess your health. Applicants who are in good health typically receive lower rates than those with pre-existing conditions, such as heart disease, diabetes, or high blood pressure. If you have health issues, some insurers may offer policies with higher premiums or may exclude certain conditions from coverage.

3. Coverage Amount

The higher the death benefit you want, the higher your premiums will be. A policy with a $500,000 death benefit will cost more than one with a $100,000 death benefit. Be sure to choose a coverage amount that aligns with your financial goals and family needs.

4. Term Length

The length of your policy’s term also affects the cost. A 20-year term policy will typically be more affordable than a 30-year policy, as the insurer has a lower likelihood of needing to pay out the death benefit. Shorter-term policies tend to have lower premiums, but you’ll need to reassess your coverage once the term expires.

5. Gender

Women generally pay lower life insurance premiums than men because, on average, women live longer than men. As a result, insurers view women as less risky to insure.

6. Smoking and Lifestyle Factors

Smokers will generally face significantly higher premiums compared to non-smokers. Insurers consider smoking a high-risk behavior that leads to various health problems. Other lifestyle factors, like dangerous hobbies (e.g., skydiving) or occupation (e.g., working in construction), can also affect your rates.

7. Insurance Company

Different insurance companies have different pricing structures, and some insurers may specialize in offering lower rates for certain demographics. It’s essential to compare quotes from multiple companies to find the best deal for your situation.

How to Compare Term Life Insurance Rates

To effectively compare term life insurance rates, follow these steps:

Step 1: Assess Your Needs

Before you start comparing rates, determine how much coverage you need and for how long. Think about your family’s financial obligations (e.g., mortgage, education costs, income replacement) and how long you want to provide financial security.

Step 2: Gather Multiple Quotes

One of the easiest ways to compare rates is to use an online quote tool or work with an independent insurance agent. These tools allow you to input basic information about your age, health, coverage needs, and term length to get quotes from several top insurers in a matter of minutes.

Step 3: Consider the Reputation of the Insurer

Price isn’t everything. You should also consider the reputation of the insurer. Look at their financial strength (check ratings from agencies like A.M. Best or Moody’s) and customer reviews. A good insurer should have a strong track record of paying claims and providing excellent customer service.

Step 4: Look for Additional Features

Some term life policies may offer additional features, such as:

- Accelerated Death Benefit: Allows you to access a portion of the death benefit if you’re diagnosed with a terminal illness.

- Conversion Option: Gives you the ability to convert your term life policy into a whole life policy later on without undergoing a medical exam.

These features can add value to your policy, so it’s worth comparing which insurers offer them.

Step 5: Understand the Fine Print

Be sure to read the fine print before committing to a policy. Check for any exclusions, limitations, or extra charges that may not be immediately obvious. For example, some policies may not cover deaths related to certain activities or health conditions.

How to Get the Best Term Life Insurance Rates

Now that you know what to look for, here are a few tips to help you get the best rates:

- Buy Early: The earlier you buy term life insurance, the better. Premiums are typically lower when you’re younger, so locking in coverage early can save you money over time.

- Stay Healthy: The healthier you are, the lower your premiums will be. Maintaining a healthy lifestyle (e.g., exercising, eating a balanced diet, avoiding smoking) can help keep your rates down.

- Consider Your Term Length Carefully: Choose a term length that fits your needs but doesn’t overextend your coverage. While longer terms are great for those who need coverage well into retirement, they can also result in higher premiums.

- Work with an Independent Agent: An independent insurance agent can help you navigate different insurers and policies, ensuring you find the most affordable and suitable coverage.

- Review Your Policy Periodically: As your life circumstances change (e.g., your kids grow older, your mortgage is paid off), you may not need as much coverage. Reviewing your policy every few years can ensure you’re not overpaying.

Final Thoughts

Term life insurance can provide peace of mind knowing that your loved ones will be financially protected in the event of your untimely passing. By comparing term life insurance rates and understanding the factors that influence premiums, you can find an affordable policy that meets your needs. Remember, the key to saving money while securing the right coverage is shopping around, understanding your options, and working with trusted professionals. With the right approach, you’ll be able to protect your family’s future without breaking the bank.

Frequently Asked Questions (FAQs) About Term Life Insurance Rates Comparison

1. What is term life insurance?

Term life insurance is a policy that provides coverage for a specific period (usually 10, 20, or 30 years). If the insured person dies within the term, their beneficiaries receive a death benefit. Unlike whole life insurance, term life doesn’t accumulate cash value, making it more affordable and straightforward.

2. How do term life insurance rates compare across different providers?

Term life insurance rates can vary greatly between providers, even for the same coverage amount and term length. Insurers take into account factors such as your age, health, gender, lifestyle habits (e.g., smoking), and the coverage amount. Some companies might specialize in offering better rates for certain demographics, which is why comparing quotes from multiple providers is crucial.

3. What factors affect term life insurance premiums?

Several factors influence the cost of term life insurance premiums:

- Age: Younger applicants typically pay lower premiums.

- Health: Healthier individuals tend to receive better rates. Conditions like diabetes, high blood pressure, or heart disease can increase premiums.

- Term Length: A longer-term policy generally costs more than a shorter-term policy.

- Coverage Amount: Higher death benefits lead to higher premiums.

- Lifestyle: Smokers or those with high-risk occupations or hobbies may face higher premiums.

- Gender: Women often pay less than men due to their longer life expectancy.

4. Can I get a term life insurance policy without a medical exam?

Yes, some insurers offer no-medical-exam term life policies. These policies usually have higher premiums compared to traditional term life policies with medical exams, and coverage amounts may be limited. While a medical exam is often required for more comprehensive coverage, you may still be able to get a policy quickly without one if you’re in good health.

5. What is the best age to buy term life insurance?

The best age to buy term life insurance is generally in your 20s or 30s, when you’re younger and healthier. The earlier you purchase a policy, the lower your premiums are likely to be. However, it’s never too late to get coverage; even people in their 40s or 50s can benefit from securing term life insurance, although premiums will be higher.

6. Can I change my term life insurance policy after it’s in place?

Some term life insurance policies offer a conversion option, which allows you to convert your term policy into a permanent life insurance policy (such as whole life or universal life) without undergoing a new medical exam. However, not all policies offer this option, so it’s important to confirm this with your insurer before buying.

7. How do I determine how much coverage I need?

The amount of coverage you need depends on several factors, such as:

- Your income: A common rule of thumb is to have 10-12 times your annual income in coverage.

- Debt: Factor in any debts you want covered, like a mortgage, car loans, or credit card balances.

- Future expenses: Consider any long-term costs, such as your children’s education, or the cost of living for your dependents.

- Other financial resources: If you already have significant savings, life insurance may only need to cover specific gaps.

A life insurance calculator can help you estimate the right coverage for your situation.

8. Are there any riders or add-ons I should consider?

Some term life insurance policies come with optional riders (add-ons) that can enhance your coverage. Common riders include:

- Accelerated Death Benefit Rider: Allows you to access a portion of the death benefit if you’re diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives your premiums if you become disabled.

- Child Rider: Adds coverage for your children. These riders can provide extra protection, but they usually come at an additional cost.

9. Can I renew my term life insurance policy after the term ends?

Many term life insurance policies include a renewal option. This means you can extend your coverage after the initial term ends, usually without needing a new medical exam. However, premiums may increase significantly when you renew, especially if you’re older or have health issues.

10. Is term life insurance cheaper than whole life insurance?

Yes, term life insurance is generally much cheaper than whole life insurance because term policies are temporary and do not accumulate cash value. Whole life insurance, on the other hand, provides coverage for your entire life and includes a savings or investment component, making it more expensive.

11. How do I get the best term life insurance rates?

To get the best rates on term life insurance, follow these tips:

- Shop around: Compare quotes from multiple insurance companies.

- Buy early: The younger and healthier you are, the lower your rates will be.

- Maintain a healthy lifestyle: Avoid smoking, exercise regularly, and eat a balanced diet.

- Choose an appropriate term length: Pick a term length that fits your needs without overextending coverage.

- Work with an agent: Consider working with an independent insurance agent who can help you navigate the best options for your needs.

12. How long should my term life insurance policy last?

The ideal term length depends on your financial goals and dependents. Common term lengths are:

- 10-20 years: Best for individuals with young children or significant debts (e.g., mortgage, student loans).

- 30 years: Suitable for those looking to cover long-term financial obligations, such as supporting a spouse or ensuring their children’s education is fully funded.

As your financial situation changes (e.g., children become financially independent), you can reassess your coverage needs.

13. Are term life insurance premiums fixed?

Yes, most term life insurance premiums are fixed for the duration of the policy term. However, some policies might have an increasing premium structure or may increase when the term is renewed. Always review the terms of your policy to understand how your premiums may change over time.

14. Can I cancel my term life insurance policy?

Yes, you can cancel your term life insurance policy at any time, but keep in mind that you won’t receive any refund for premiums already paid unless the policy has a return of premium feature. If you cancel, make sure you don’t leave yourself without coverage, especially if your dependents rely on your life insurance for financial security.

By understanding these FAQs, you can better navigate the world of term life insurance and make an informed decision about the best coverage for your needs. Always take time to compare rates, research policy options, and seek professional advice to ensure you’re getting the best deal.